By Jens Kengelbach, Georg Keienburg, Tobias Söllner, Dominik Degen, Sönke Sievers, Daniel Friedman, and Lianne Pot

What does it take to succeed in M&A? For the past two decades, BCG’s annual M&A reports have explored the answers to this question. Since launching the series in 2003, we have covered a number of areas of new ground. Recent themes include the rise of tech deals, the economics of synergies, the alternatives to M&A, and green dealmaking. Recurring themes include the promise and peril of making deals in a downturn.

One constant in our studies is an emphasis on the elements that drive genuine, long-lasting deal success. Our goal has been to equip dealmakers with actionable insights that enhance their chances of creating value—or at the very least, help them recognize when they are gambling against the odds. Such insights have been essential to excelling in a market that has experienced its fair share of ups and downs. (See “M&A’s 20-Year Rollercoaster Ride.”)

M&A’S 20-YEAR ROLLERCOASTER RIDE

To mark the 20th anniversary of our M&A Report, we looked back at our rich history of analyses related to deal value creation. We refreshed these insights using our proprietary data set of more than 900,000 deals spanning three decades. Our goal was to discern the success factors that distinguish top-tier dealmakers from the rest of the pack.

Among the many pivotal factors that we encountered, ten imperatives stood out as consistently crucial for M&A success. These success factors have withstood the test of time, remaining as significant in our updated analyses as when we first identified them.

Be prepared and systematic. M&A can feel like the least plannable of business activities, as potential deals often arise spontaneously and opportunistically. And when the right target finally comes into the crosshairs, it is easy to succumb to deal fever. But as in all other significant investment situations, it pays to be well prepared—even though, as the saying goes, “no plan survives first contact with the enemy.” Having the right team, tools, and established processes in place comes in very handy when the reality of a deal suddenly emerges.

Buyers need a detailed M&A strategy linked to the company’s strategic direction, carefully thought-out target search criteria, clear financial guardrails for evaluating deals, and playbooks for due diligence and especially post-merger integration. In our many surveys and analyses, we have found that acquisitions fail far more often because of a misguided M&A strategy or an inappropriate approach to integration rather than because of excessively high purchase prices or inadequate due diligence.

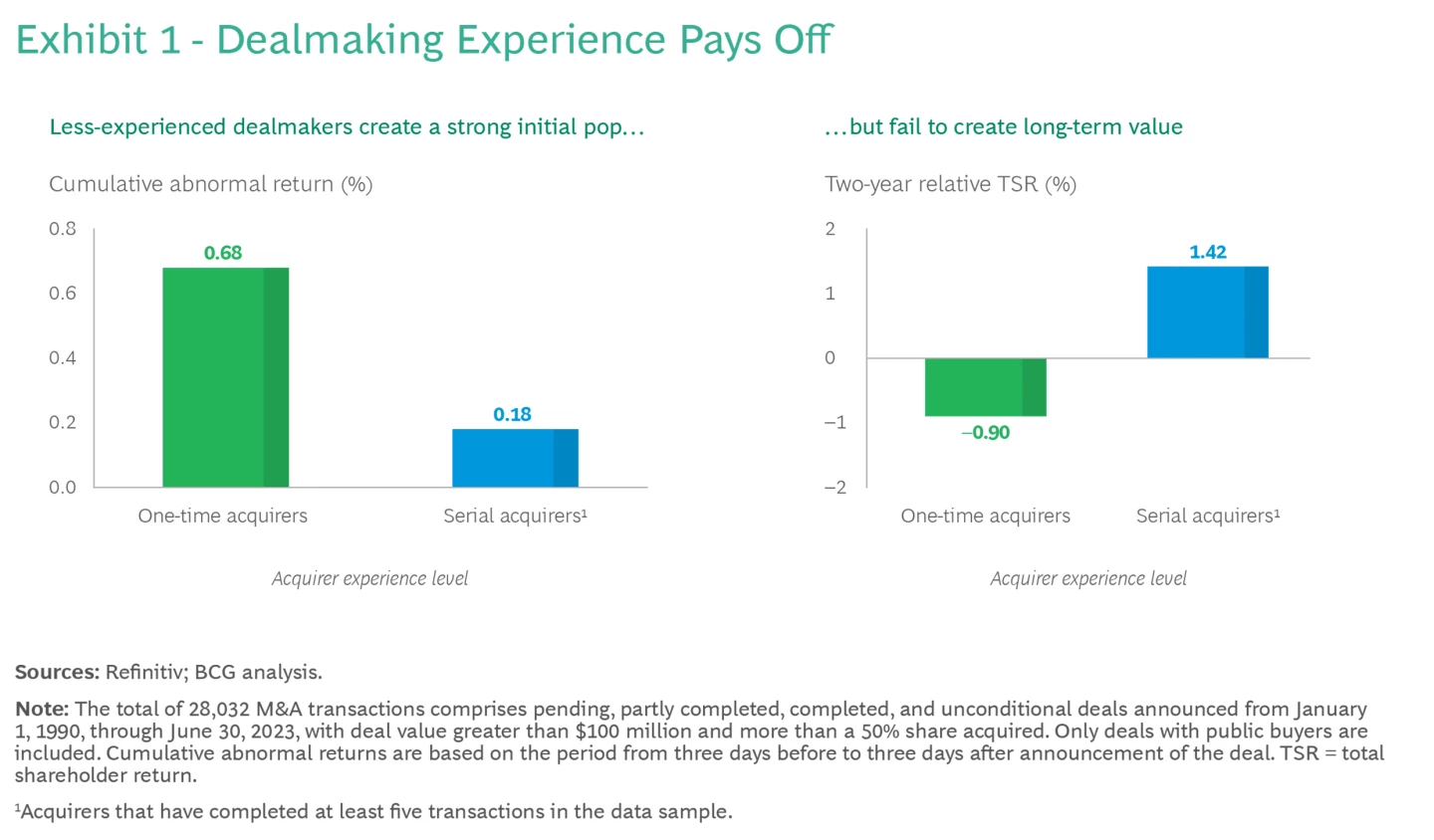

Build experience. Experience matters in M&A. Experienced acquirers can ramp up more quickly in time-critical M&A situations, are more precise in their due diligence, and know where the integration pitfalls lie. Experienced sellers know when to go to market, can prepare their assets properly, and negotiate more shrewdly. They also know when to walk away from a deal that is not meeting their objectives.

Our research has repeatedly confirmed that companies that regularly engage in dealmaking create superior returns, while less-experienced companies tend to destroy value. (See Exhibit 1.)

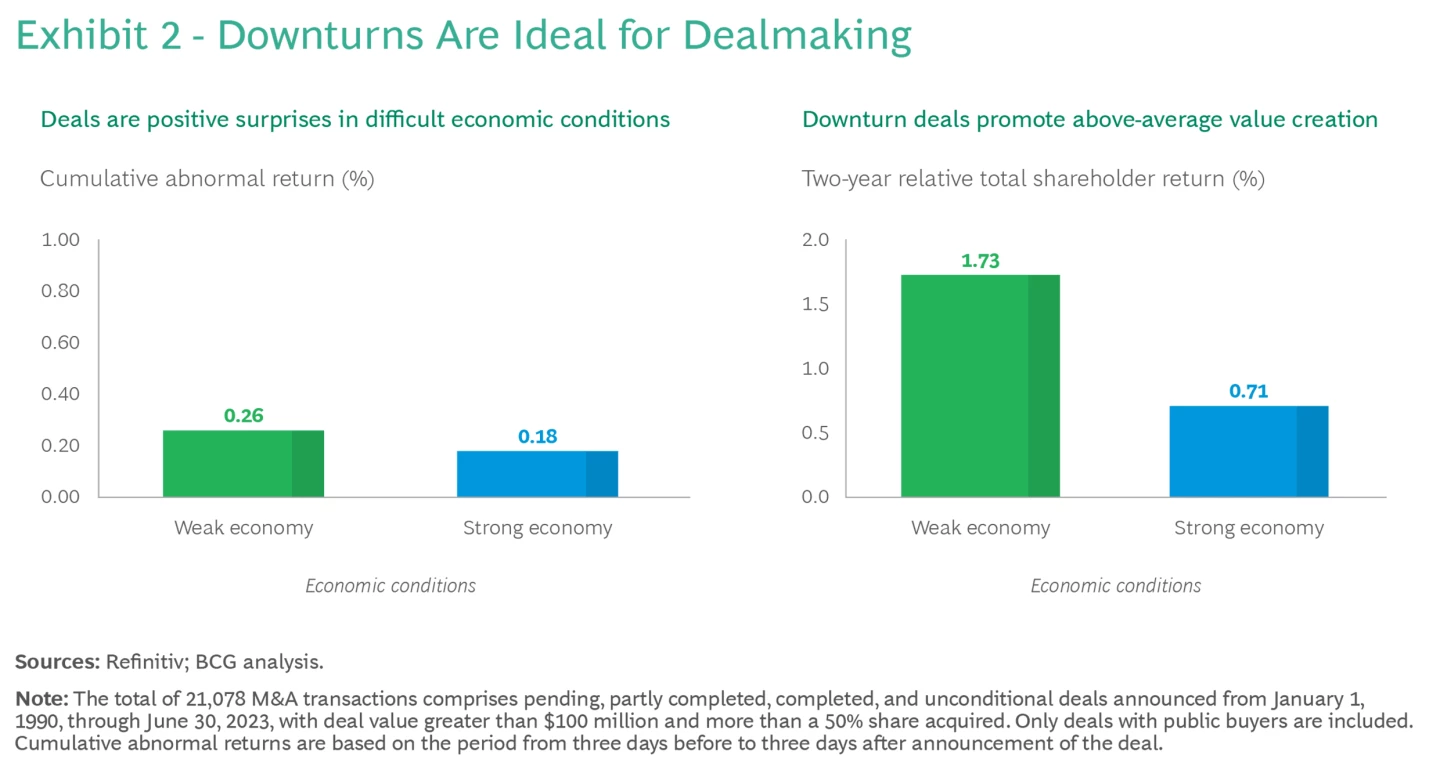

Master the art of timing. In M&A, as in many other areas of business, timing is half the battle. Arriving late, whether in the broader M&A or business cycle or in a specific deal situation, typically results in diminished post-deal value creation or a missed opportunity altogether.

Our research indicates that dealmakers achieve the highest returns early in the cycle, often within the first two years. Interestingly, downturns have consistently proved to be prime periods for deal hunting. (See Exhibit 2.) Nevertheless, optimal timing can fluctuate depending on sector, region, and economic situation, as well as on company-specific factors.

Go outside your comfort zone, but not too far. Ever since conglomerates went out of fashion, the consensus in the Western business world has been that the best approach is to focus on the core business—not least from a shareholder perspective. In the M&A context, however, the situation is more nuanced. Our research shows that deals involving a company’s core products or regions do not create the most value. Rather, transactions in which dealmakers go outside their comfort zone yield higher returns over the long term.

This may sound counterintuitive, but a closer look clarifies the picture. Yes, go beyond your comfort zone, but do not stray too far: cross-border deals, for example, are most successful if they remain in a company’s core region. This is understandable, given the challenges posed by unfamiliar regions and cultures. Similarly, deals focused on adjacent products and services that lie relatively close to a company’s core offerings yield more value than those that aim for broad diversification. At the other extreme, although pure rollups and scale expansions can be beneficial, they are unlikely to drive long-term outperformance. The keys to staying ahead of the pack are innovation and a degree of continuous reinvention. Rigorously sticking to one’s core may be effective for a while, but eventually a broader strategy will be necessary.

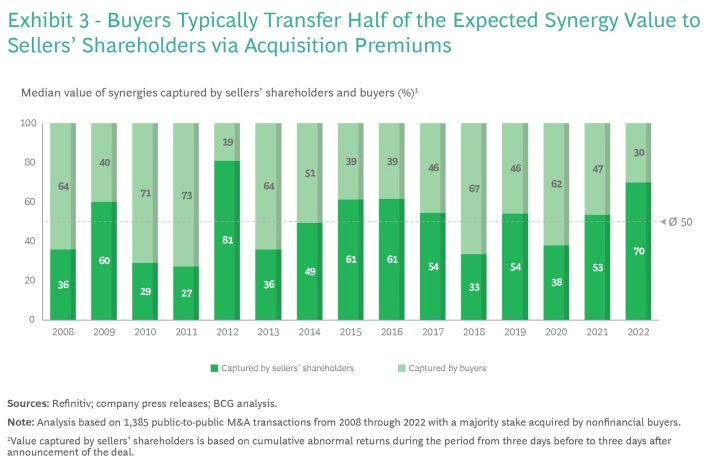

Focus on synergies—they justify the deal. The importance of emphasizing synergies might seem obvious, since synergies are at the core of value creation in corporate M&A. By making acquisitions feasible when a target is not sufficiently attractive by itself, synergies allow corporate buyers to edge out financial sponsors in tight bidding situations.

Merely identifying potential synergies is a far cry from realizing them, however, and their value diminishes if the buyer simply passes them on to the seller via a higher purchase price. Our research reveals that, over the past 15 years, buyers in public M&A deals have retained only about 50% of synergies; the rest tends to be factored into the purchase price, although this rate fluctuates with market conditions. (See Exhibit 3.) Our studies repeatedly indicate that insufficient or unrealized synergies are among the main reasons why some deals are deemed failures.

To address this criterion effectively, it is crucial to begin with a precise synergy estimate. This entails investing intensively in analysis—ideally starting from the outside in—before the deal officially commences. A proactive approach allows bidders to dedicate more attention to second- and third-order questions in the due diligence phase, thereby optimizing their use of the limited time. Solid synergy estimates lead to better valuations and more effective negotiations, preventing an erosion of the deal’s potential value creation due to overpayment.

Once the deal is inked, the focus should swiftly move to capturing the synergies, and here, typically, time is of the essence. Buyers should enlist the support of a clean team composed of third-party personnel no later than between signing and closing. This team can facilitate the exchange of highly sensitive data that is critical for refining synergy estimates.

The 2023 M&A Report

The 2023 M&A Report

2023 M&A Report: M&A Is Looking Up After Bottoming Out

M&A activity is rebounding after hitting a low point early this year. Sustainability, digitization, and capital scarcity are leading factors shaping the dealmaking outlook.

2023 M&A Report: The Regional Perspective

BCG experts in six regions discuss the state of play in their M&A market and share insights about near-term deal drivers.

M&A Activity by Year: The BCG M&A Report Collection

BCG has published a mergers and acquisitions report—covering M&A activity by year, the state of the M&A market, and perspectives on deal-making trends—annually since 2003. Explore the full series, including the latest BCG M&A report.

The real test lies in the execution. Companies must transform their thorough synergy estimates into tangible savings and growth—a task that requires a rigorous approach to post-merger integration. Units responsible for integration should be deeply involved in synergy estimations from the outset. To ensure that the business can realize these estimates, the right incentives—value-driven, substantial, and within the recipient’s control—must be in place, supported by a dedicated oversight process.

Finally, communication is crucial. Our analyses show that acquirers that clearly announce their synergy targets and provide timely follow-up information reap higher shareholder returns.

Don’t be seduced by megadeals. The allure of megadeals is undeniable, promising a legacy-defining transaction for executives. Unfortunately, these large-scale deals more often erode value than enhance it. Engaging in major transformative M&A is an extremely risky strategy, given the intricacies of due diligence, execution, and post-merger integration. Such deals can also distract management, causing them to overlook other critical areas of the business.

Our research consistently shows that serial acquirers of small to midsize targets generate the highest long-term value creation. Although these smaller acquisitions demand recurring effort, they are simpler to evaluate, manage, and assimilate. Regularly engaging in such deals strengthens the organization’s M&A capabilities, fostering experienced and well-coordinated teams, streamlined processes, and tested playbooks.

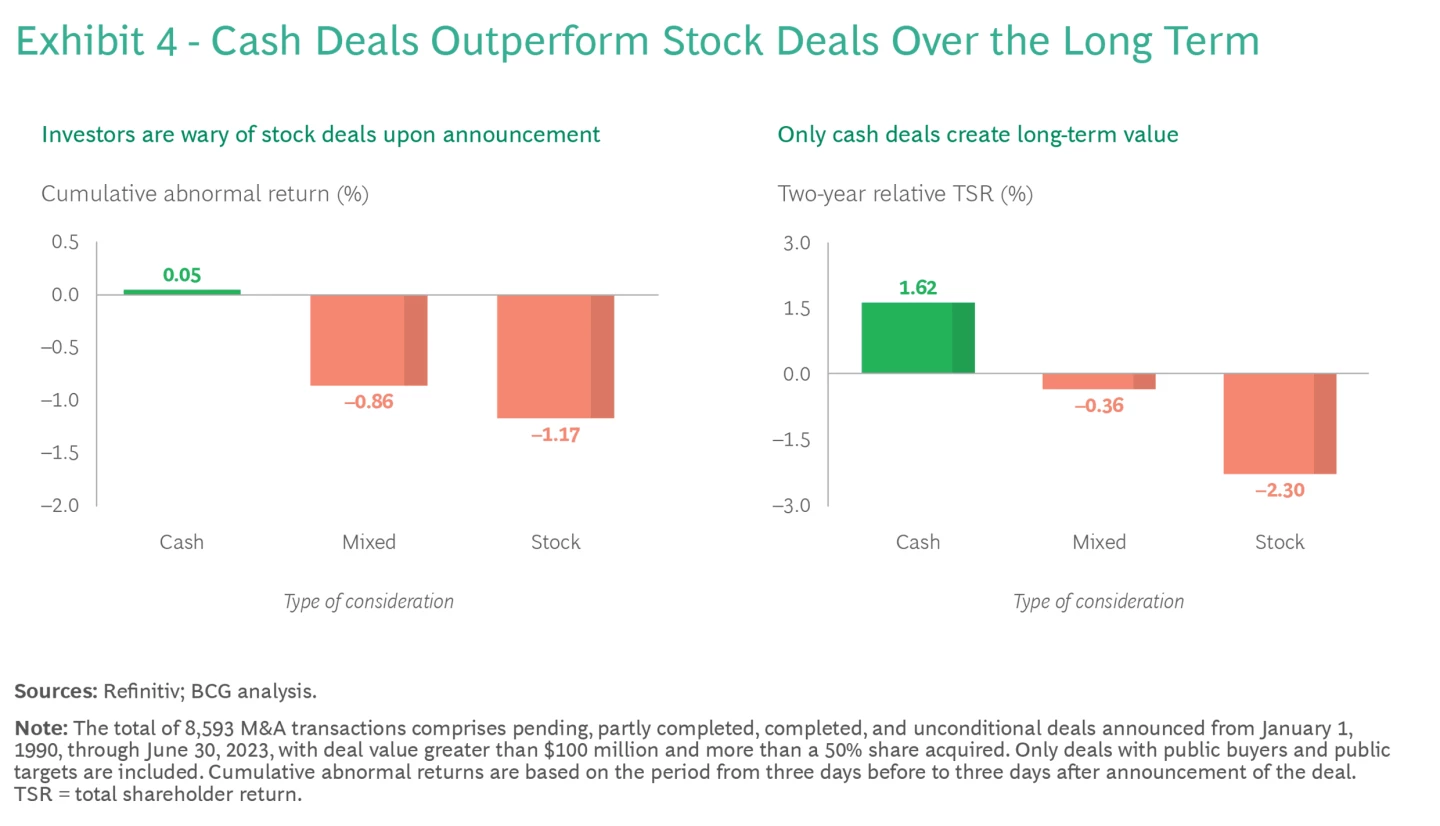

Pay more, but only with cash. Common wisdom suggests that overpaying is never profitable, but our research finds that this is not entirely accurate. Although the greatest value creation typically arises from deals with below-average multiples, maximum benefits emerge when low multiples are paired with high premiums over current market valuations. Perhaps counterintuitively, this insight suggests that dealmakers should seek opportunities where they can afford a substantial premium over an asset’s current market value due to the asset’s low valuation and the potential for significant synergies. In simpler terms: look for bargains, especially in today’s fluctuating market environment.

After identifying undervalued targets, rely solely on cash for transactions. (See Exhibit 4.) A cash-only approach ensures discipline, particularly in valuations—a crucial element in times of limited and more expensive capital. Conversely, stock-for-stock mergers tend to underperform, resulting in subdued investor expectations as reflected in lower announcement returns.

Think outside the box. Traditionally, the default tool for dealmakers has been the plain-vanilla 100% acquisition, on both the buying side and the selling side. For instance, over the past two decades, majority deals outnumbered minority ones by about 3 to 1, although the annual ratio has evolved from 4 to 1 two decades ago to 2 to 1 more recently, largely owing to the rise in VC financing. The attraction of majority deals is clear: they are relatively simple to value and negotiate, and they are amenable to straightforward governance after closing. But in today’s ever-more-complex M&A and business landscape, this approach is not always optimal.

We have observed a consistent rise in alternative deal types, such as minority shareholdings, joint ventures, strategic partnerships, and corporate venturing. These structures may be more complex to execute and manage after closing, but they open new strategic options by giving dealmakers much-needed flexibility to customize capital allocation in response to specific conditions. Given the shift from the past decade’s abundant capital to the current scarcity, these alternative approaches have become an indispensable part of an experienced dealmaker’s toolbox.

Embrace transparency. Within the typically guarded world of M&A, some executives may not view open communication as a top priority. However, our research suggests that strategic communication at specific stages of the M&A process can bolster value creation. First, investors should not be surprised by potential acquisitions. Putting them on notice requires having an M&A strategy that is clear and well-communicated without limiting management’s strategic flexibility. Second, once a deal is signed, communicating credible and sufficiently detailed plans for synergy and integration (including material ESG efforts) gives investors a baseline for measuring deal success and instills confidence in management’s ability to deliver. Third, internal communication is equally vital. Effective dialogue within the organization facilitates the integration of new acquisitions by setting a unified vision and purpose from the outset. Overlooking internal communication creates the risk of losing top talent during integration or carve-out efforts.

Double down on integration design and execution. The importance of execution to successful deal outcomes cannot be overstated. One of our most extensive studies on deal success factors reveals that 30% to 40% of deals fail as a result of, among other factors, poor planning or a lack of strategic fit. In almost half of the failed deals, inadequate or misguided post-merger integration was either among the root causes or the primary cause of the disappointing value creation.

It is essential to remember that closing a deal is only the beginning of the journey, not its culmination. The true challenge of value creation lies ahead, and missteps can negate the hard work and thoughtful preparation that preceded the closing. Following BCG’s 12 imperatives for integration success, based on over two decades of hands-on experience, can help companies avoid pitfalls.

M&A is one of the most complex and risky endeavors a management team can undertake, and larger deals only raise the stakes. The pitfalls are numerous, ranging from overlooking a critical risk during due diligence to underestimating the challenges of post-merger integration. And, of course, ever-present economic and market uncertainties loom large over any significant investment. By adhering to our ten lessons, dealmakers can increase their likelihood of success—especially if they pair these imperatives with a competent team, commitment, hard work, and a willingness to take risks. Simply put, fortune favors those who are not only bold but also well prepared.

Sunbelt has an experienced team of brokers covering the market with expertise in all vertical industries. We know your industry – and we know the business community. LEARN ABOUT OUR TEAM MEMBERS.

Samuel Baird Managing Director

DIRECT NUMBER: 801-687-7472

EMAIL: sbaird@sunbeltlv.com

GET A NO-COST, CONFIDENTIAL BUSINESS VALUATION.

CONTACT A SUNBELT BUSINESS BROKER TODAY!

When you are considering selling – or buying – a business in Las Vegas, Henderson, or the surrounding area, Sunbelt Las Vegas is your best answer.

We are committed to confidentiality, integrity, and professionalism. When you choose Sunbelt Business Advisors, you save time and money with an authority in business sales you can trust.

That’s why we connect more buyers and sellers than anyone, anywhere.

CALL: 702.364.2551 and connect with the Sunbelt Las Vegas team now.