Article adapted from Axial

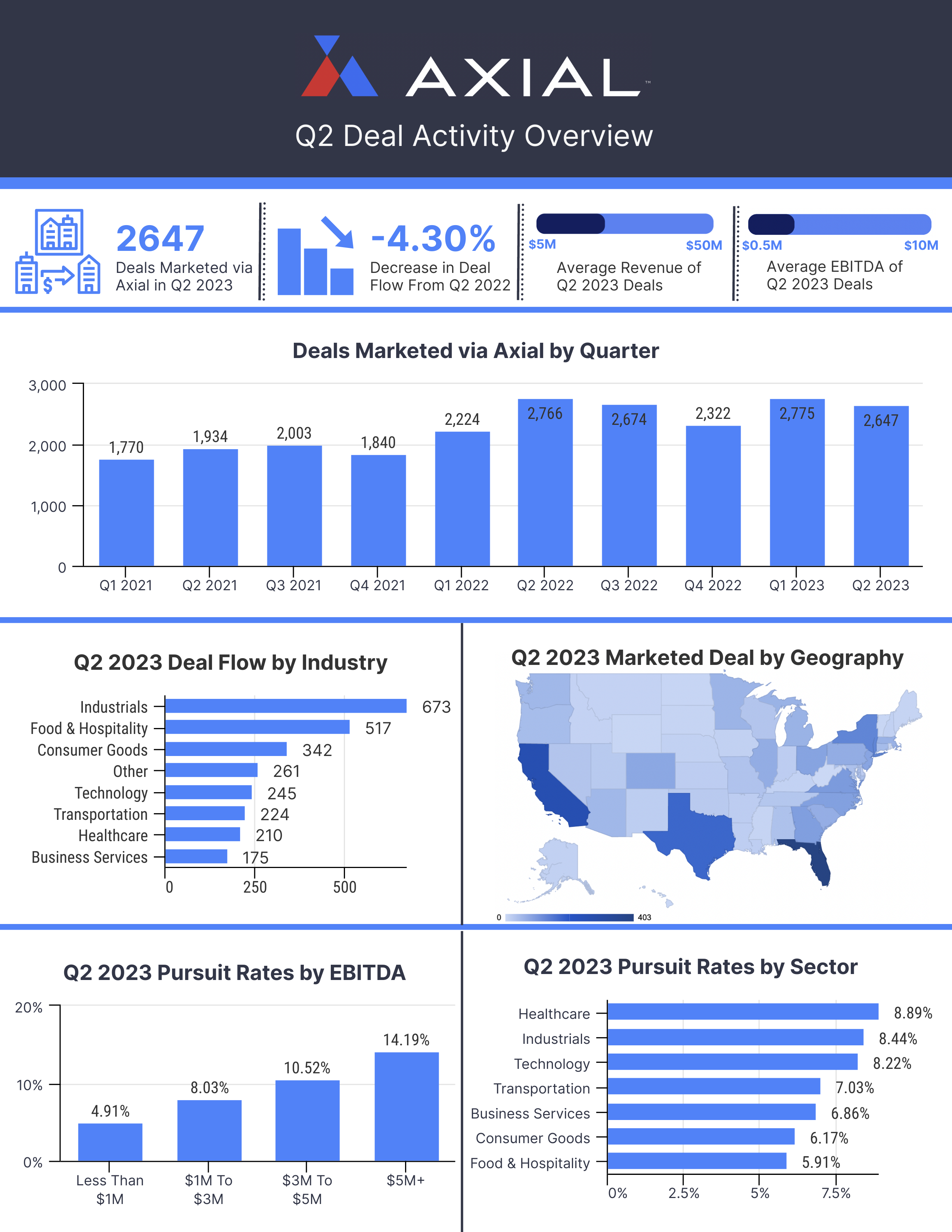

Welcome to the second issue of The SMB M&A Pipeline, a quarterly publication from Axial. The series surfaces a top of the funnel breakdown of the deal activity occurring on Axial’s platform. The aggregated metrics include quarterly deal volumes, financial and geographic characteristics, and pursuit rates, sorted by quarter and also by industry category.

All deal data is fully anonymized to protect the confidentiality of these transactions.

What Are Pursuit Rates?

“Pursuit rate” measures the rate at which Axial’s buy-side members register interest in a deal that an Axial sell-side member has invited them to consider. If NDAs, IOIs, and LOIs reflect the deepening progression of interest among acquirers on a given deal, the pursuit rate is one step higher in the funnel than the signed NDA. It offers insight into the forward deal pipeline and the initial interest level of prospective Axial buy-side members.

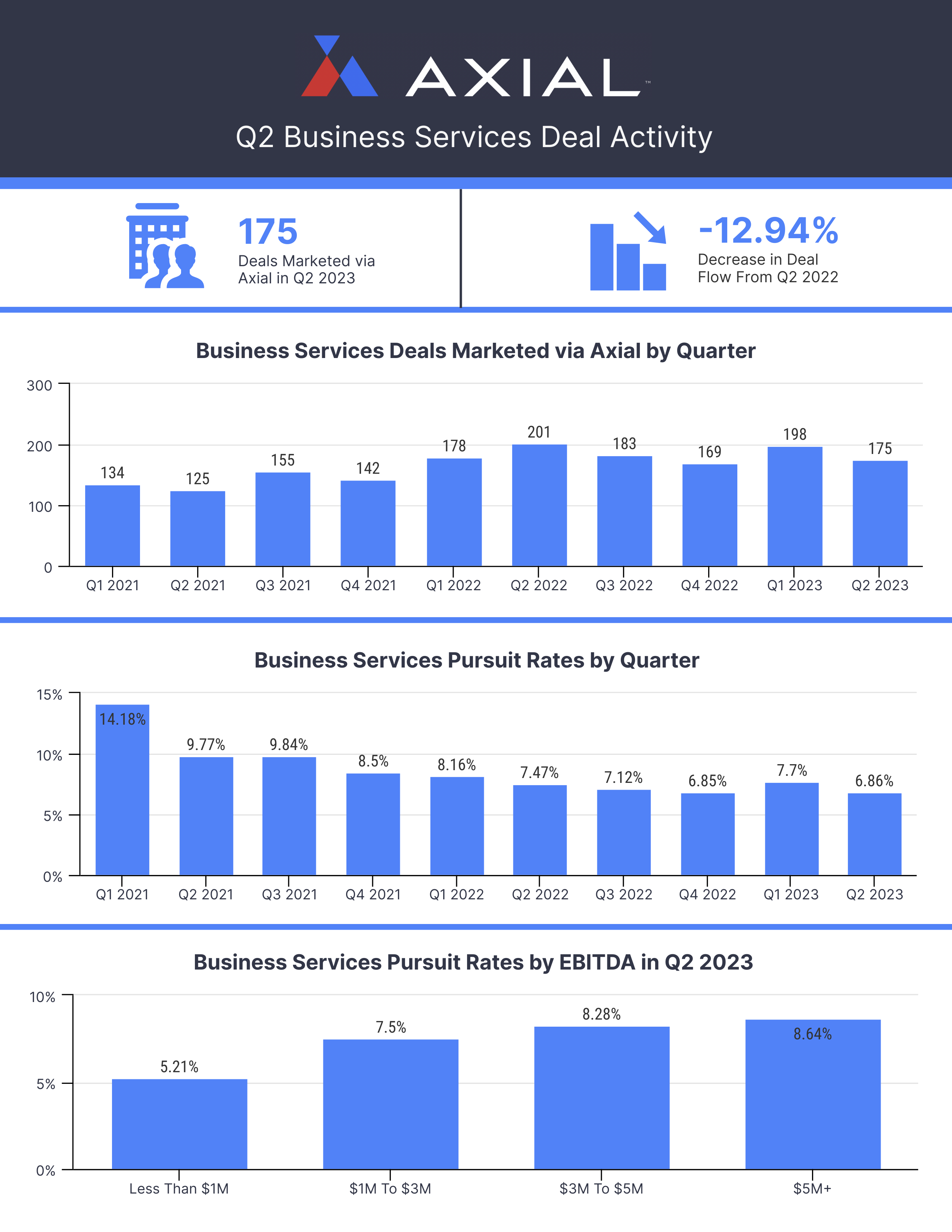

An Overview of Q2 2023

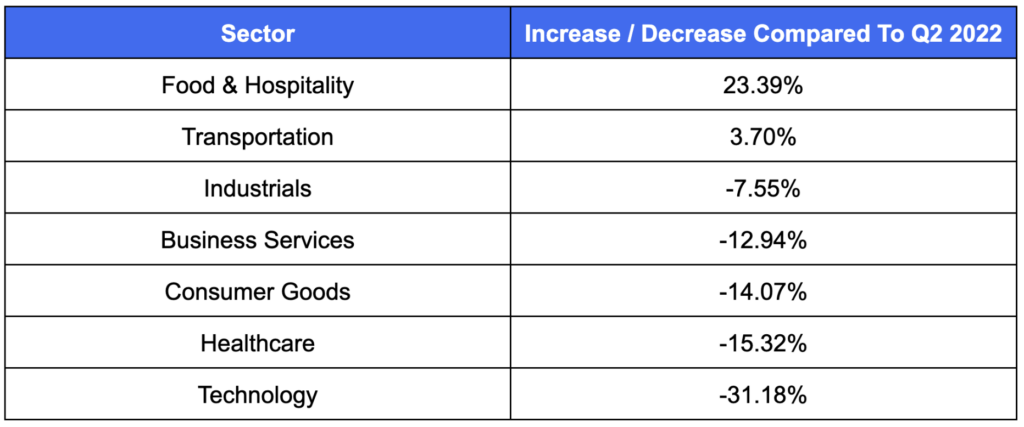

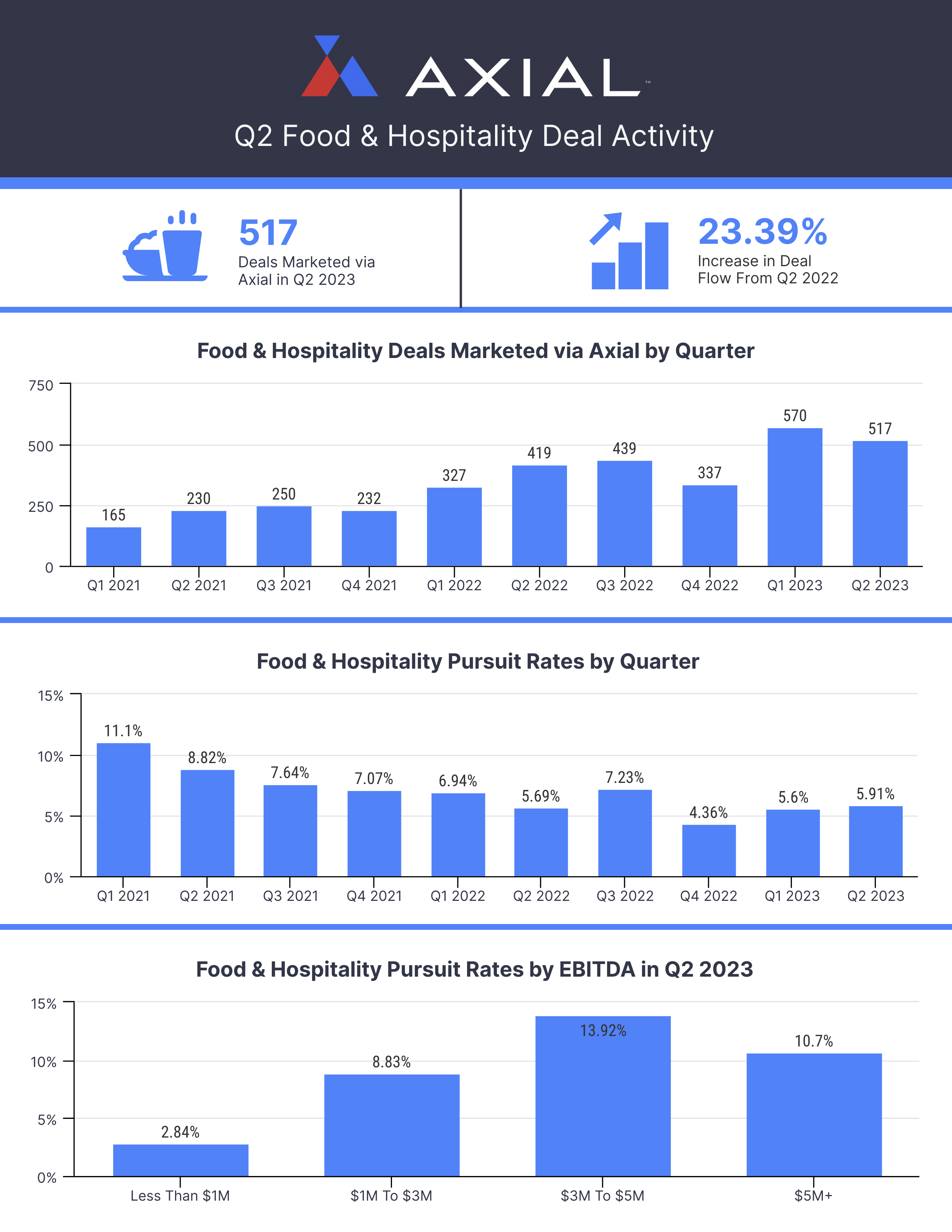

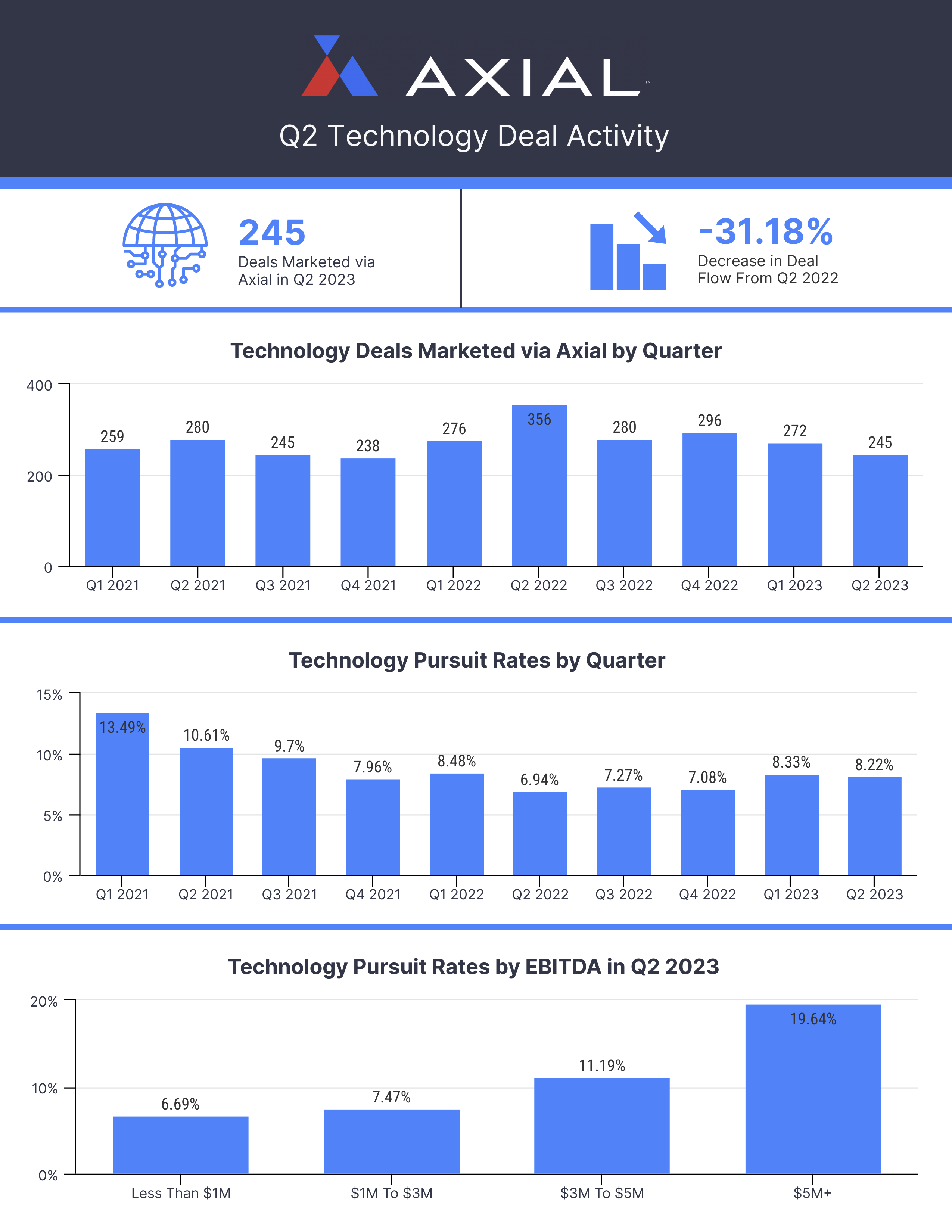

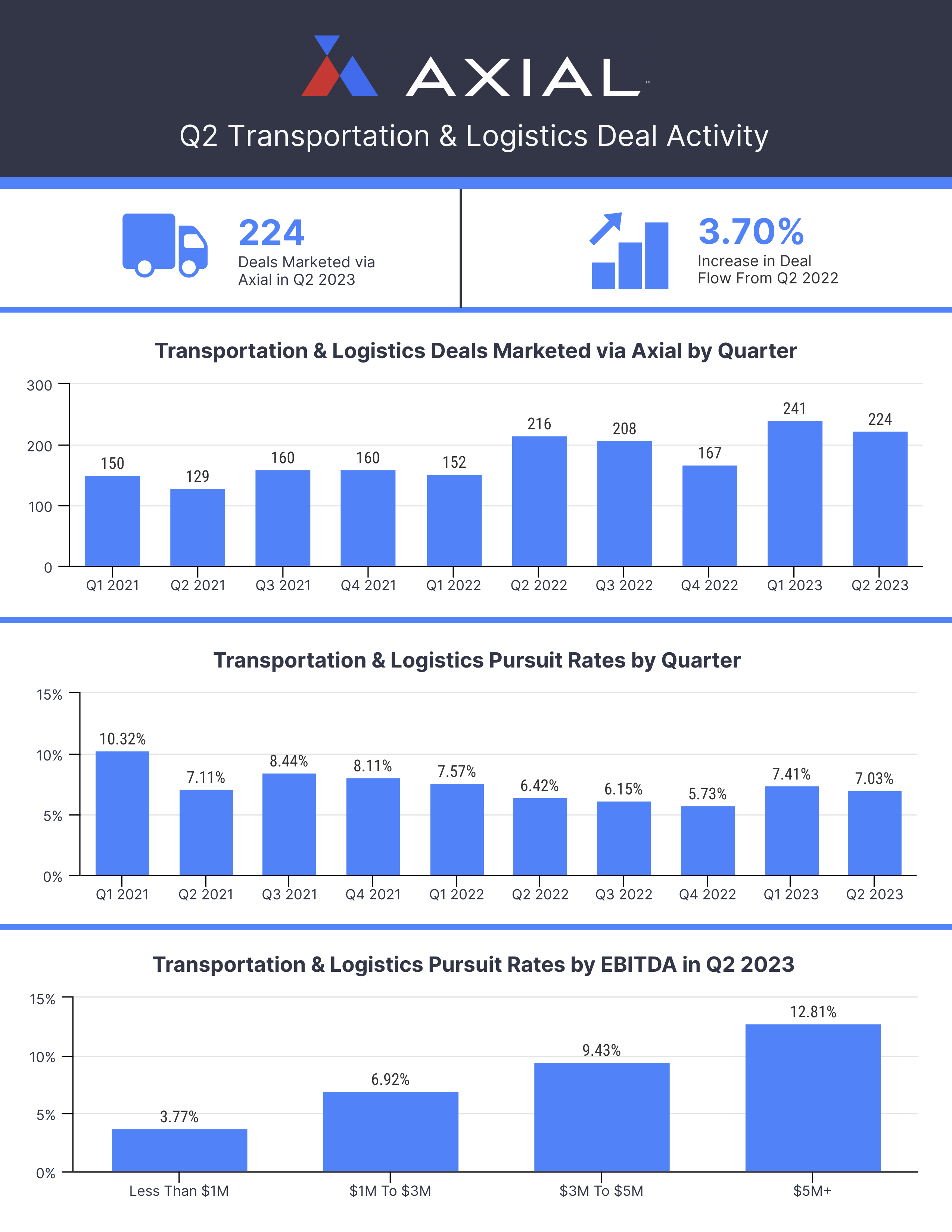

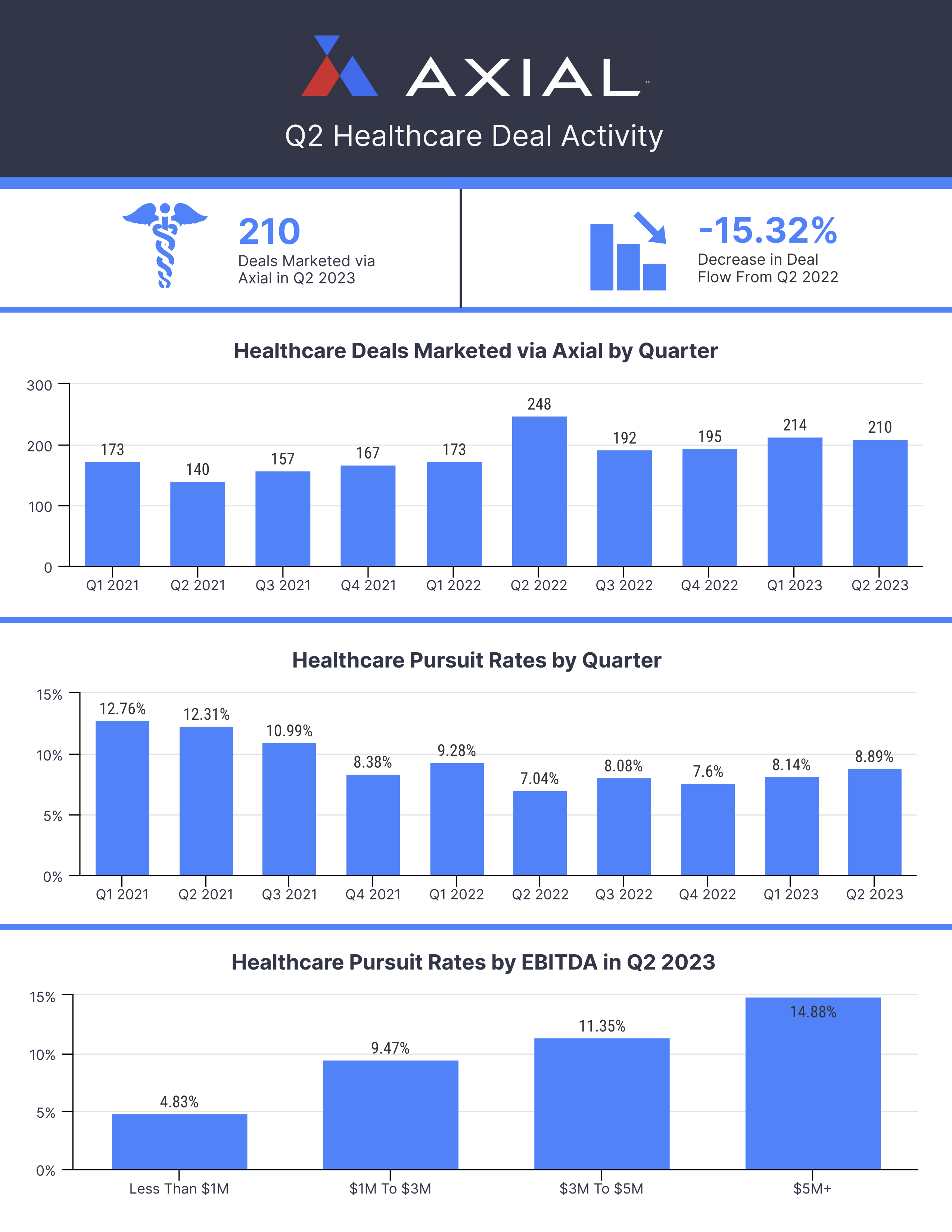

We saw 2,647 deals come to market in Q2, 4.30% lower compared to the same time period last year. Food & Hospitality had the highest YoY deal flow (see below table). The sector continues to see immense growth this year, as Q1 saw a YoY increase of 74%. The annual growth in the Transportation sector slowed down, up 3.7% YoY in Q2 relative to 60% YoY in Q1. The Technology sector, on the other hand, had the highest YoY deal flow decrease.

Deal Volume vs. Pursuit Rate

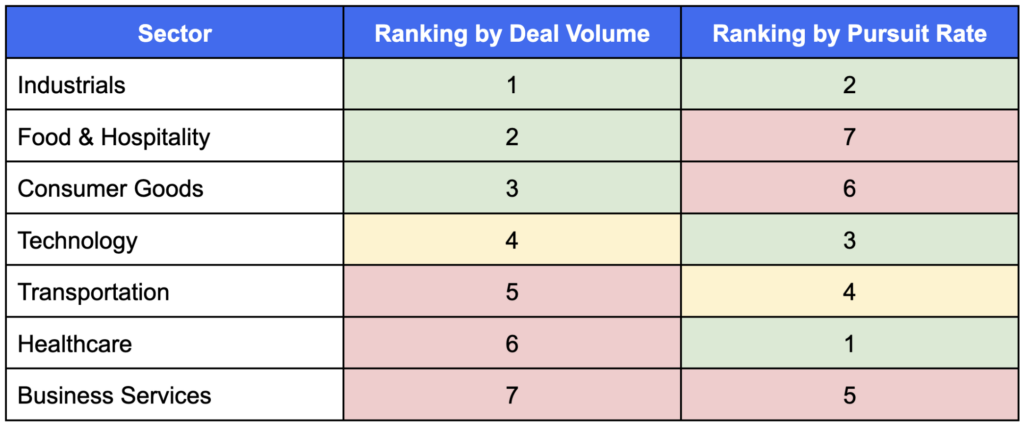

The biggest discrepancy regarding these two metrics was in Healthcare, which ranked 6th for deal flow but 1st for pursuit rate. Food & Hospitality and Consumer Goods ranked 2nd and 3rd for deal flow but 7th and 6th for pursuit rate, respectively. Business Services experienced a little more consistency in both categories, ranking in the bottom 3 for both deal flow and pursuit rate.

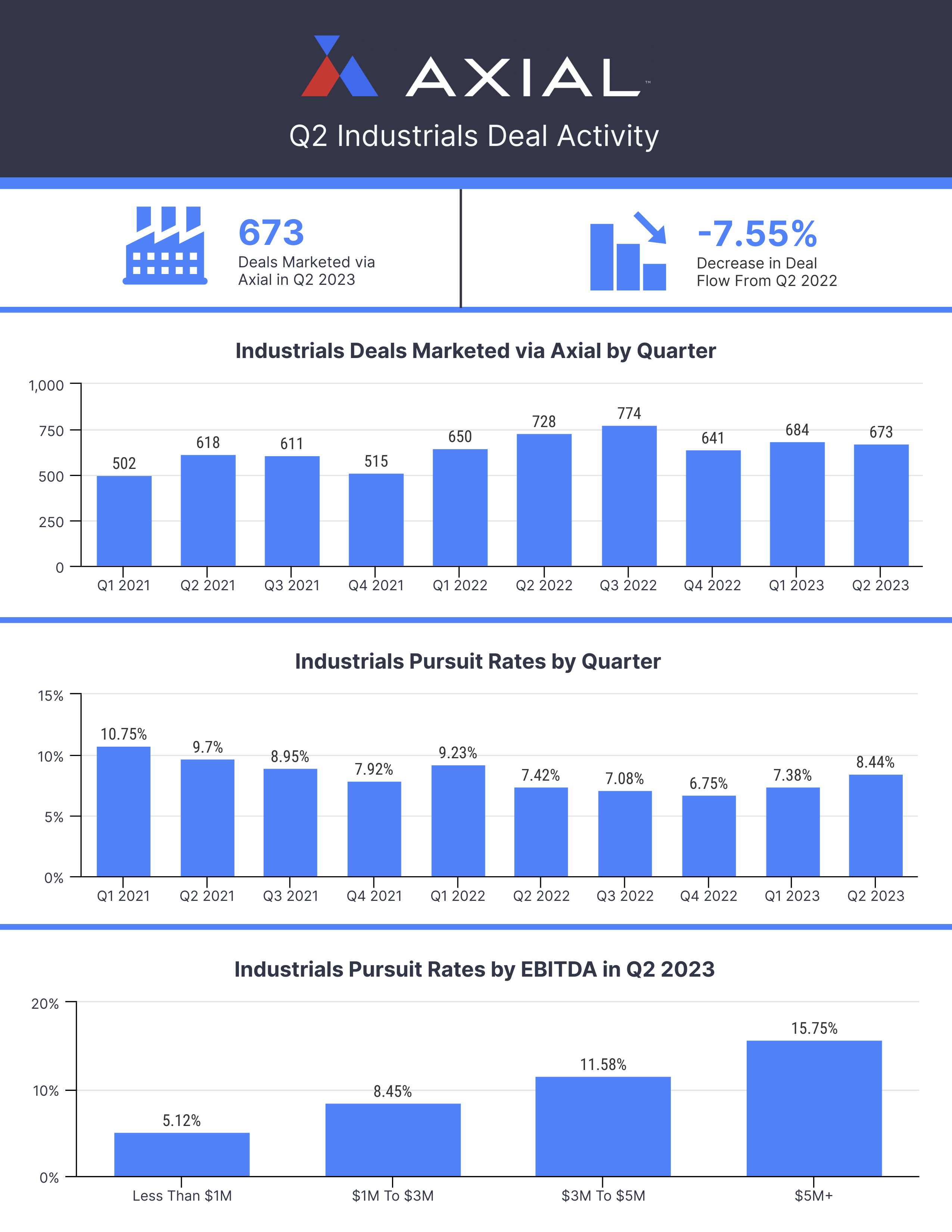

Below are a set of industry-specific and overall deal activity tearsheets that lay out a complete breakdown of deal activity in Q2 on Axial. Feel free to share and incorporate the data into your materials as you see fit.

If you have feedback or ideas for how to improve The SMB M&A Pipeline quarterly report, please email: kaitlinn.thatcher@axial.net.

Click here to learn more

Buying a business is a life-changing decision. Most of the buyers who come through Sunbelt’s doors have never owed a business before.

Our average buyer is a bit nervous, full of questions and looking for a life change. Sunbelt is here to help buyers find a business that best matches their interested and financial need. Once a buyer finds the ideal business, Sunbelt will assist them in the process of purchasing the business. Working with Sunbelt will help simplify the transaction. Just visit us for a confidential interview.