Business Planning Services

Strategic, Lender-Ready Business Plans for Growth, Financing & Exit Preparation

A well-crafted business plan is more than a document—it’s a roadmap for growth, a tool for securing capital, and a critical step for owners preparing to buy, scale, or sell a business. At Sunbelt Las Vegas, we help business owners create clear, compelling, and financially grounded business plans that meet the needs of banks, SBA lenders, investors, and potential buyers.

Why a Professional Business Plan Is Essential

Whether you're seeking SBA financing, preparing to enter the market, planning an expansion, or positioning your company for an eventual sale, a lender-ready business plan provides clarity and credibility.

A strategic business plan helps you:

Understand your company’s current financial and operational position

Identify areas for improvement and growth

Communicate your vision, strategy, and financial expectations

Strengthen your position with lenders, buyers, or investors

Prepare your business for market with realistic timelines and expectations

Sunbelt Las Vegas combines real-world business sale expertise with proven planning methodology to help owners develop actionable and industry-aligned plans.

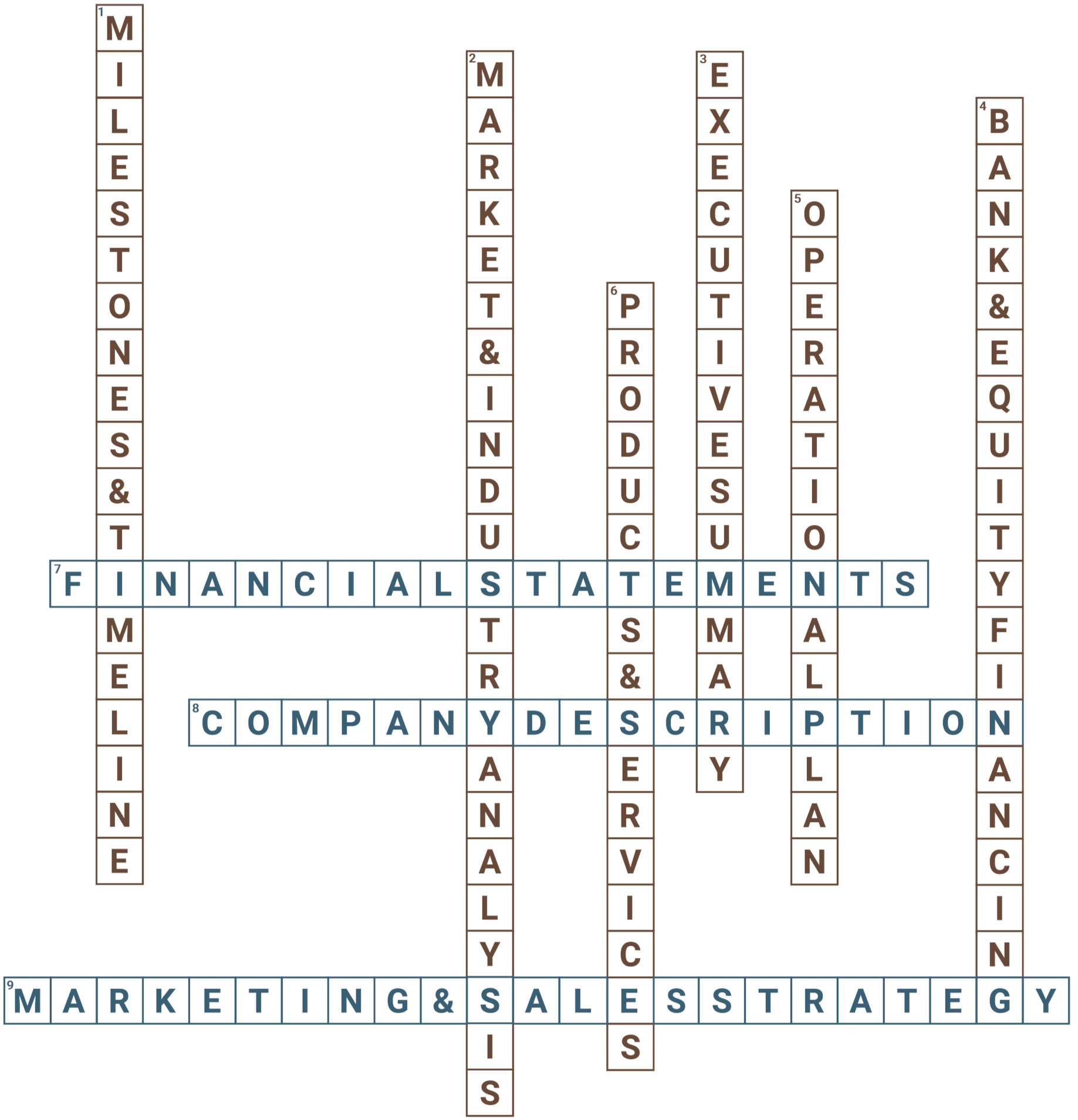

Core Elements of a Business Plan

Every business plan we help develop is tailored to your business, your industry, and your goals. Consider these core elements of a tight business plan and give us a call at 702.364.2551.

Down

1. Milestones & Timeline

2. Market & Industry Analysis

3. Executive Summary

4. Bank & Equity Financing

5. Operational Plan

6. Products & Services

Across

7. Financial Statements

8. Company Description

9. Marketing & Sales Strategy

SBA Finance

Sunbelt Finance knows how to get you pre-qualified for an SBA loan. We understand the challenges and responsibilities that come with business ownership. Our services are at no cost to the buyer and are paid for by the lender after you successfully attain the loan.

The 5 C’s of SBA Loan Eligibility

Capital

Capital refers to the down payment—or equity injection—you invest in the business. SBA lenders rarely finance 100% of the project, so showing a strong personal investment is critical. For SBA 7(a) loans, banks typically want 20% down for existing businesses or franchises, though 10% may be accepted for highly qualified buyers. The exact amount required depends on your loan type and business profile.

Credit

Just as it does when you apply for any kind of financing, your credit score and credit history play a role in whether you’re approved for SBA lending. Most banks will look at both your personal and business FICO score. A 690 personal score and 160 business score are typically the minimum requirements for loan approval. Credit events such as recent bankruptcy can have a significant negative impact on your attractiveness as a borrower.

Capacity

Capacity refers to your business’s ability to generate enough cash flow to repay debt, measured by the debt service coverage ratio (DSCR)—operating cash flow divided by debt obligations. Lenders typically require a DSCR of at least 1.25 and will review recent tax returns, profit & loss statements, and balance sheets. They also assess your debt-to-income ratio (DTI) to gauge personal financial health, aiming for DTIs below 36%. Strong personal income can help improve loan eligibility.

Character

Lenders look at both your personal and your business character when evaluating your strength as a borrower. Most importantly, your business experience—especially in the industry of the business you’re hoping to fund—will play a factor in the eyes of lenders. However, you’re also required to provide information about events in your personal history that speak to your personal character, such as details about child support payments, criminal convictions, and recent arrests.

Collateral

Your personal property may be used as collateral to secure your loan. For example, the bank may take a lien against your primary residence to use as security if the loan goes into default. However, unlike the other eligibility requirements, it’s possible you may not be denied a loan if you don’t have enough collateral to secure it—as long as all other requirements are met.

To facilitate third-party debt financing, call us at 702.364.2551.

Strong Planning Is the First Step Toward Maximizing the Value of Your Business

Whether you're looking to secure financing, grow your company, or prepare for an eventual exit, Sunbelt Las Vegas provides the guidance and clarity needed to move forward with confidence.

Fill out the form below and a Sunbelt Las Vegas business advisor will get in touch with you.

If you need help with larger, more complex deals, Masterworks Capital embraces the same mindset as Sunbelt Business Advisors, with a sharper lens for the $10M–$250M range.

Visit: www.mworkscapital.com